Encouraging signs of growth are emerging in Singapore. A year ago, Singapore Management University launched Business Families Institute (BFI) backed by government to build an ecosystem buttressing the boom of family offices. “Three years ago, there was a conscious attempt by the Monetary Authority of Singapore to have the right ecosystem of professionals, lawyers, private bankers (we already have such a nice catchment area) to support the family offices set-up,” says Professor Annie Koh, academic director at BFI.

With the region’s wealthiest at the cusp of wealth transference, the initiative underscores Singapore’s commitment to prolong the longevity of family riches beyond generations. The move is also upping the ante of growth potential of family offices in Asia, which is still in its infancy despite notable growth of regional investable wealth. As an indication of the scale of potential for family offices in the coming years, Richard Straus, head of Citigroup Private Bank, expects the number of Asian family offices to rise to 1,500 by 2015.

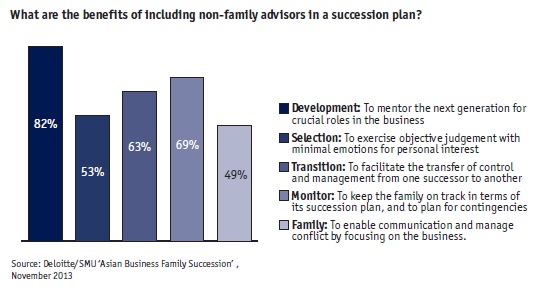

The aftermath of the global financial crisis has eroded much trust in several large private banks as wealthy clients became wary of their sales culture. “When the crisis came in 2008, banks suffered and were ranked very lowly in the area on whom to trust,” says Professor Koh. “Although trust levels remain low, they have improved. Many families do recognise the need for trusted advisers because they have certain expertise that adds value,” she adds. According to a recent joint report by Deloitte and BFI, trusted non-family advisors are growing in importance to facilitate leadership turnover. Successive generations are also more open-minded to accept nonfamily member management in the business. A sobering study by Capgemini revealed that about 30% of Asian family businesses survive into the second generation and only 10% into the third.

As the new generation of the ultra-rich gets increasingly well-educated and worldly, the needs of family offices have also grown more complex. The next generation demands a more holistic international approach to meet their diverse needs such as tax compliance in different jurisdictions, philanthropy and lifestyle management. They also have the tendency to major in fields outside their traditional family business.

With growing numbers of elite clients finding the alignment of interests by private bankers problematic, some large private banks have responded by ramping up dedicated family services tailored to their needs. In 2010, Swiss banking giant UBS established a Global Family Office in the Singapore. Other major players include Credit Suisse, HSBC, Citi Private Bank and Singapore-based DBS Private Bank. The move underscores the long term commitment some private banks have in place for clients. However, such move “is a trust call and only banks with very deep pockets can do this,” says Professor Koh. “Private banks must consider what exactly are the family needs right now and it may not lead to new money being given to you. So, there may be a pressure but those who do it right know it is beyond managing money,” she adds.

To read more, please click here.